22+ peer to peer mortgage

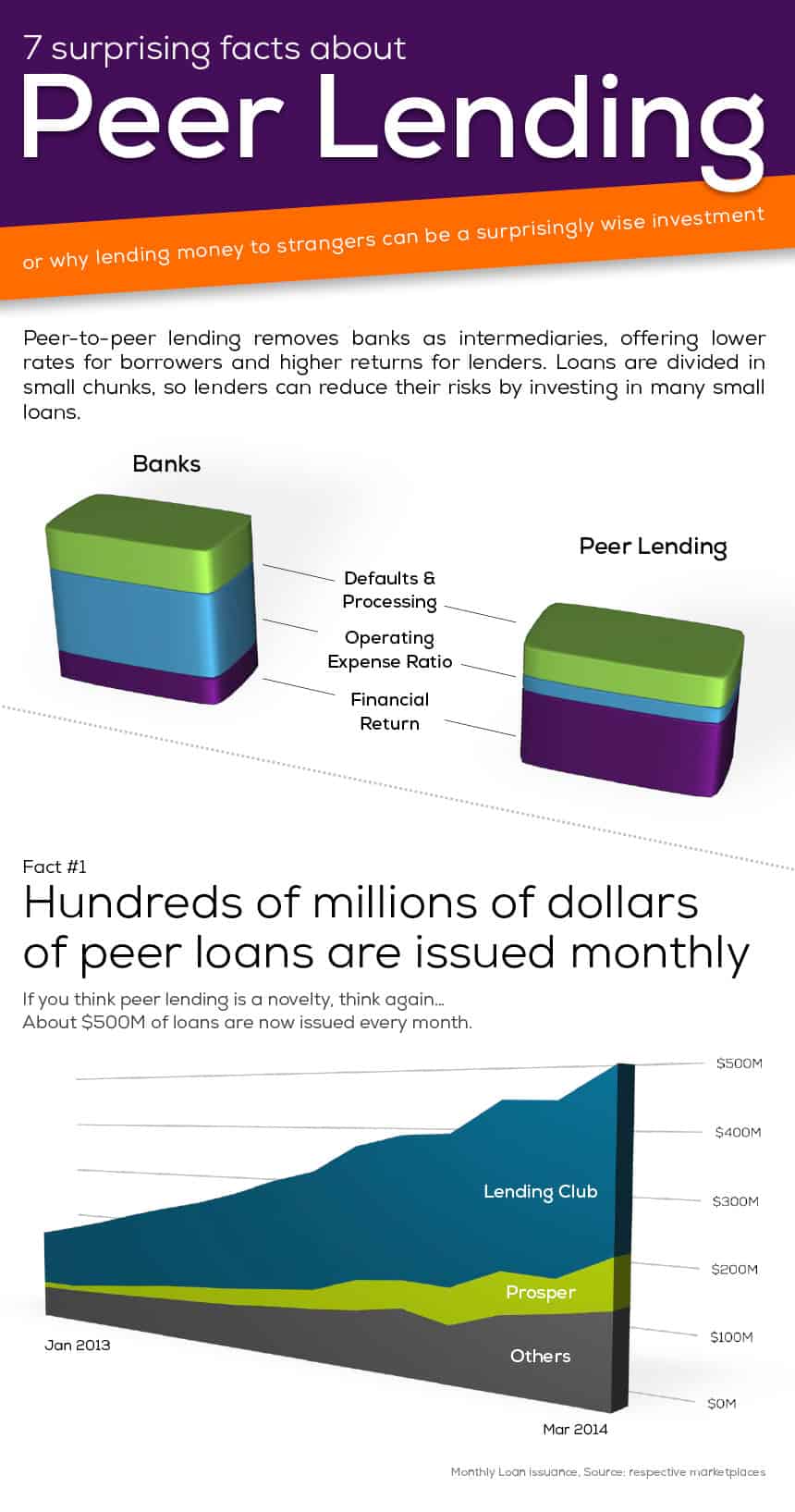

Other loan types are available as well. Web Peer-to-peer lending also called P2P or marketplace lending allows borrowers to take out online loans largely funded by institutional investors as an alternative to traditional sources of.

St George Page 10 Productreview Com Au

Web Peer-to-peer lending is the borrowing and lending of money through a platform without the help of a bank or another financial institution.

:max_bytes(150000):strip_icc()/GettyImages-1317950427-4eecdef61152467d9ea1ce2773d1640d.jpg)

. For example Upstart requires only that you have been in business for six months. Web Platforms facilitating Peer to Peer Lending Peerform. The check payment fee is the lesser of 5 or 5 of.

This is a high-risk investment. Lending Club 7 The Advantages and Disadvantages of Peer-to-Peer Lending The Advantages of Peer-to. This form of social lending aims to make financing and investing more accessibleand.

Dont invest unless youre prepared to lose money. Web Four of the more popular peer-to-peer sites that provide business loans include Lending Club Prosper Upstart and Funding Circle. Personal Peer-to-Peer Loans 2.

What this means is that for the first time private investors can lend directly to property investors thereby accessing the. Web San Francisco-based peer-to-peer lender SoFi offers both mortgage and mortgage refinance loans in 29 states and the District of Columbia with more on the way. Web Peer-to-peer lending refers to the practice of lending money directly to individuals or businesses without an official financial institution participating as an intermediary in the deal.

Web Of course peer to peer lending for mortgages does include some potential risks to all parties involved. With a P2P loan its a person funding your loan instead of a. Web SoFi a California-based service is one of the relatively few companies facilitating peer-to-peer mortgages and mortgage refinancing.

Web Peer-to-peer P2P lending cuts out the middleman and lets borrowers get loans directly from individuals. There are several popular platforms that facilitate this type of lending more on those later. Web Peer-to-peer lending basically works by connecting online borrowers who need funds to investors who can issue loans even though they never directly interact.

If your payments are late a P2P lender may also start to raise interest rates or add. Web Depending on your risk rating your fee can be 240 to 500 of the loan amount. Intermediary platforms or companies are online investment platforms that match lenders and borrowers.

Web Peer-to-peer or P2P lending is a relatively new lending service that connects lenders directly with borrowers. Prosper also charges fees if you make your payments via check. Web Peer-to-peer loans are personal loans funded by individual investors or institutions.

See our picks for the best peer-to-peer loans from online lenders. Web The peer-to-peer lending concept is gradually spreading to the property market. Web Peer to Peer Loans Loans from 2000 to 1 million Loans provided by a financial community built on transparency fairness and inclusivity.

By Amrita Jayakumar and Chanell. Web Peer-to-peer loans may look like many bank loans with some marketplace lenders offering fixed interest rates on loans as large as 40000 to 50000 with terms ranging from three to five years. Web Peer-to-peer lending P2P lending also known as marketplace lending is a form of lending in which consumers receive personal loans funded by individual investors.

Each offers different parameters for the loans that they will make to your business. You can compare it to how eharmony does the legwork for you to find your perfect match without the actual talking and dating stuff. Homebuyers can borrow up to 3 million with as little as 10 percent down with products that include 30- and 15-year fixed-rate loans ARMs and an interest-only option.

Education Peer-to-Peer Loans 3. Some of the web platforms available are now brokering commercial mortgages. Founded in 2012 Upstart has been involved in the origination of more than 78 billion of consumer loans.

Another firm National Family. Web However peer-to-peer lenders may send a defaulted loan to a collection agency in as little as 30 days. Unlike traditional mortgages these loans are often short-term and have less payment flexibility which can make it hard for borrowers to make their payments should something unexpected occur.

Typically an online company brings together borrowers who need funding and investors who put up cash for loans in exchange for interest payments. Web The peer-to-peer P2P lender is now offering mortgages and says it intends to help home buyers purchase sooner as well as qualify for more financing than other lenders provide. One new P2P start-up Relendex will deal in nothing else.

Business Peer-to-Peer Loans 6 5 Peer-to-Peer Lending Apps in 2023 1. Founded in 2010 Peerform provides loans to applicants with excellent credit scores who can enjoy interest. Web 5 3 Types of Peer-to-Peer Loans 1.

9 Free Sample Loan Agreement Templates Printable Samples

Peer To Peer P2p Lending Bank On Dave And Many Icma Centre

The Ultimate Guide To European P2p Lending In 2023 Jean Galea

Peer To Peer Lending Platforms Remove Banks From The Investment Equation

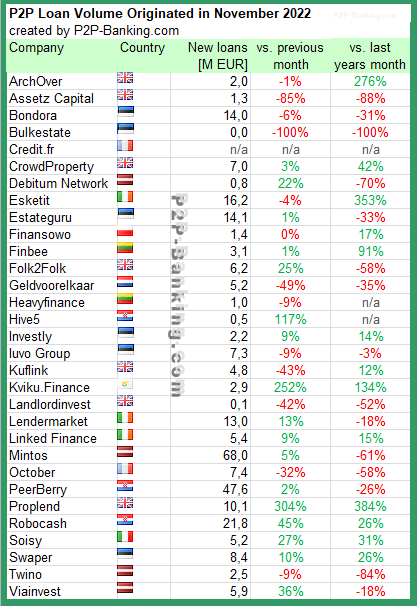

International P2p Lending Volumes November 2022 P2p Banking

French Peer To Peer Lending Hits 2 1bn In 2022 Peer2peer Finance News

Mqcc Meta Quality Conformity Control Organization Mymortgagequote Twitter

P2p Sector Smashes Milestones In 2022 Peer2peer Finance News

In 2022 Peerberry Investors Funded Eur 537 5m Of Loans Peer To Peer Lending Marketplace Peerberry

Events Archive Page 3 Of 19 Minnesota Mortgage Association

9 Free Sample Home Mortgage Checklists Printable Samples

Madison Square Park Tower 45 East 22nd Street Nyc Condo Apartments Cityrealty

Facts About Peer To Peer Lending Infographic Crowdfund Insider

The Rising Popularity Of Peer To Peer Lending Centerpoint Advisors

2022 Industry Report P2p Lending Bure Valley

9 Free Sample Home Mortgage Checklists Printable Samples

Nrmla 2022 Western Regional Meeting Nrmla